Grey Innovation Investment Partners

Authorised representative 1283807 of Australian Financial Services License 334 906

Grey Innovation Investment Partners is currently raising funds for a first close.

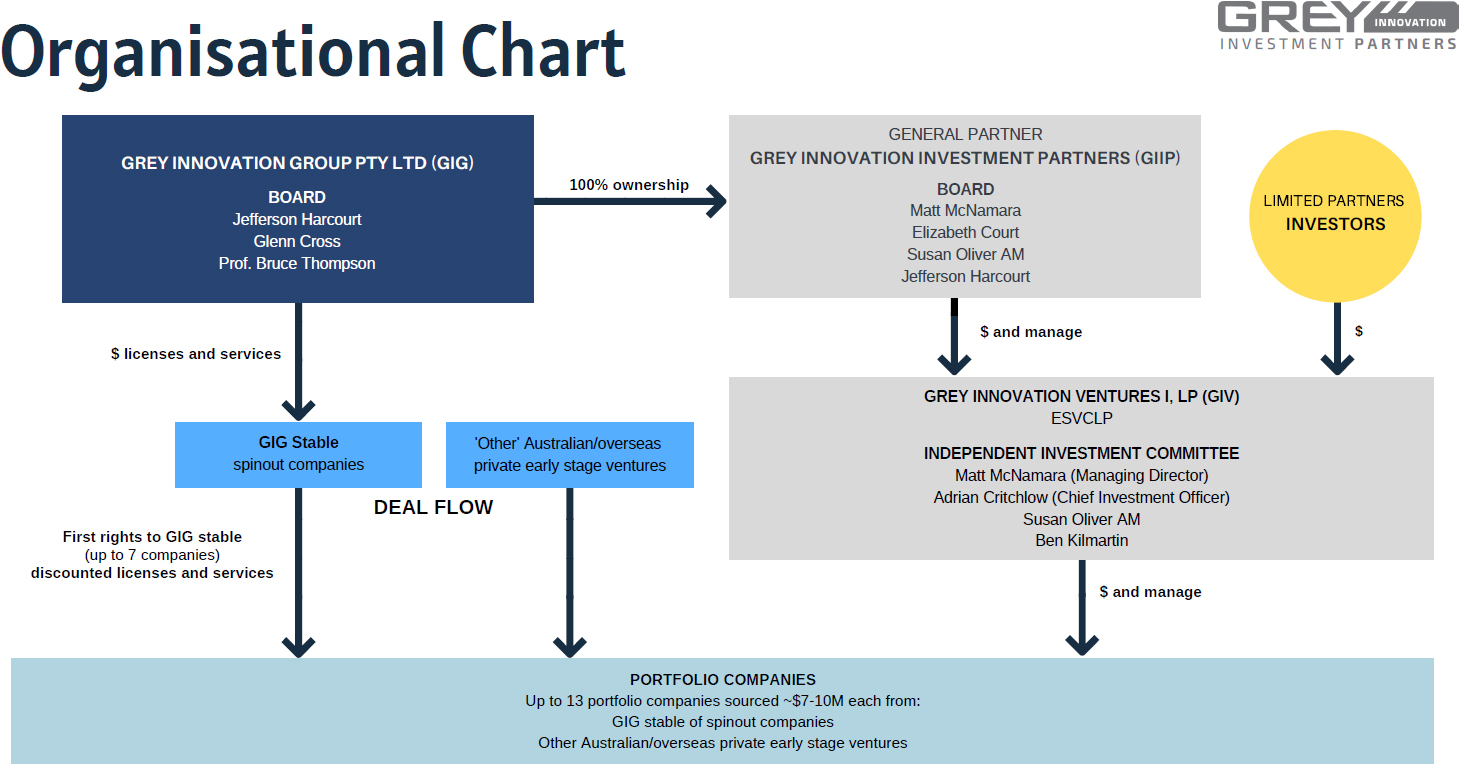

Decreasing the traditional risk of the ESVCLP model, Grey Innovation Investment Partners, is investing in sophisticated early-stage companies. Although working independent of Grey Innovation Group, the fund has first market access to Grey Innovation Group's suite of portfolio companies in, or approaching, early-stage revenue, significantly reducing the risk.

Now is our time to make an impact

An ESG Impact Fund

We strive for a positive ESG impact alongside strong financial returns.

The future of Environmental, Social and Governance (ESG) lies in the commercialisation of technology that focuses on responsible and sustainable operations and outputs. Grey Innovation Investment Partners seeks to invest in early-stage technology that improves lives and benefits the planet.

Strict ESG mandates and policies underlining the Fund are critical for thorough risk analysis and decreasing overall portfolio risk. We consider ESG risks and opportunities throughout every step of the investment process and apply our strict responsible investing principles to all investments within the Fund.

UN Principles of Responsible Investment signatory

Grey Innovation Investment Partners commits to ESG transparency and accountability. The PRI is a set of six voluntary and aspirational principles for incorporating and reporting on ESG throughout the investment process. Grey Innovation Investment Partners has committed to abide by and report on the UN Principles of Responsible Investment.

Downloads